Introduction

First: Scope

Second: Design

Third: Organization

Fourth: Data collection

Fifth: Disaggregation

Sixth: Review

Seventh: Publication

Eighth: Assessment

Ninth: Management

Introduction:

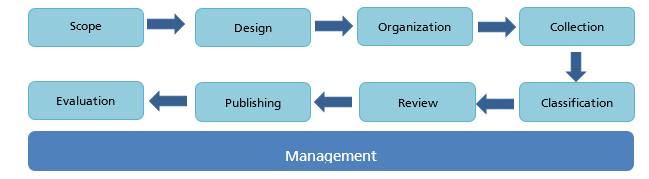

The General Authority for Statistics (GaStat) applies in all its statistical work a unified methodology that conforms with the nature of each statistical product. It depends on the Handbook of Statistical Work Procedures, which is compatible with internationally approved procedures. Statistical products go through eight major stages, in addition to a ninth stage represented in the comprehensive “management” stage which is illustrated in the following figure and the subsequent explanations:

The first three stages (scope, design and organization) are collaborative stages between GaStat and its clients who are data users from development entities. The fourth stage (data collection) is a collaborative stage between GaStat and the statistical population, whether they are households or establishments, to complete data and information. The remaining stages (disaggregation, reviewing and publication) are statistical and are undertaken by GaStat. Afterwards, the eighth stage (assessment) is again done in collaboration with the clients. The management stage is administrative and organizational and spans all other stages. Those stages have been applied to the finance and insurance survey as follows:

First Stage: Scope:

It is the starting point for producing the finance and insurance survey. It is also the first collaborative stage between GaStat and a number of relevant government entities concerned with finance and insurance statistics, such as:the Saudi Arabian Monetary Authority, the Council Of Cooperative Health Insurance, and certain insurance companies. Workshops and meetings were held at this stage between the authority and these entities to reach a better understanding of their needs and know their requirements, given that they are the providers or users of data. The views of these entities are taken into consideration to ensure the attainment of all the goals of the finance and insurance survey, which are summed up as follows:

1. Supporting decision-makers, policymakers, researchers, and those who are interested in getting comprehensive and updated statistics on finance and insurance activities in Saudi Arabia.

2. Providing data on financial and insurance activities to develop indicators in a manner that help identify growth rates.

3. Updating the series of economic statistics on financial and insurance activities.

4. Determining how many workers are involved in the finance and insurance activity

5. Identifying the volume of change in workers' remunerations, as well as other expenses and revenues of financial and insurance activities.

6. Providing the needed statistical data and information on the financial and insurance activity for government entities and agencies as well as researchers.

7. Utilizing this data for the purposes of local, regional and international comparisons and conducting studies and analyses.

Second Stage: Design:

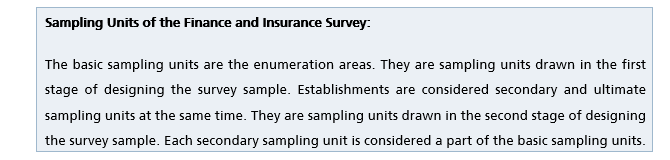

This stage is for designing statistical work as an integrated product. It also includes identifying the statistical population, designing the statistical framework and the survey sample along with its questionnaire, identifying the method and tools of data collection and identifying the sampling units. Clients are made partners in all those procedures to benefit from their observations to meet all requirements and ensure that they are part of the statistical product.

The most important outputs of this stage are:

1. The Statistical Population:

The target statistical population within the finance and insurance survey is composed of all economic establishments included in the International Standard Industrial Classification of All Economic Activities (ISIC-4) in the Kingdom.

2. Statistical Sources:

The finance and insurance statistics are based on the field survey conducted by GaStat on a yearly basis and are listed under the classification of (economic statistics). Data is collected in the survey through visiting a sample of establishments that represent all administrative regions of the Kingdom of Saudi Arabia, as well as completing an electronic questionnaire that includes a number of questions. Estimations and indicators are provided within the survey in relation to finance and insurance activities in Saudi Arabia.

3. Finance and Insurance Survey Terminology and Concepts:

3.1 Monetary intermediation: The process of receiving money in the form of deposits. Deposits are fixed amounts of money that are obtained on a daily basis from non-financial sources, except those obtained from central banks.

3.2 Financial leasing: A type of leasing where the leasing term covers the useful life of the asset.

3.3 Loans: An amount of money lent by financial institutions, normally secured by movable and immovable property, in exchange for future repayment of the loan value amount along with annual interest. Loans are classified according to many factors, such as: maturity date, security type, status of the borrower, or the amount of the borrowed money.

3.4 Investment: The process of investing money, which includes investing in assets. Assets or stocks are considered investments if they generate regular profitable returns or income over an extended period of time, or if their value increases with time.

3.5 Insurance: An annual or monthly subscription paid to an insurance company by the insured in exchange for providing a guarantee of compensation in the event of a covered loss.

3.6 Activities auxiliary to financial intermediation: Activities that provide services related to financial intermediation even if they do not include any financial intermediation themselves, such as: management of financial markets, activities that deal with securities, and other auxiliary activities.

4. Indicators:

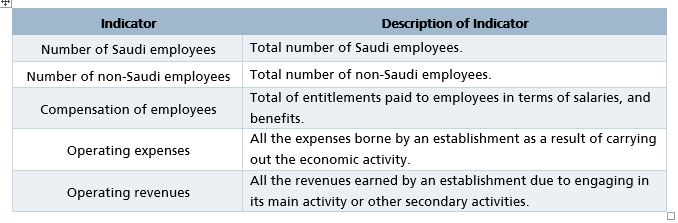

The most important indicators of the finance and insurance survey are the following:

5. Adopted Statistical Classifications:

Classification is defined as being an arranged set of related categories used for data collection according to similarity. It is the basis for collecting and publishing data in all statistical fields, such as economic activity, products, expenditures, jobs or health, etc. It allows for classifying data and information through putting them into meaningful categories to produce useful statistics, considering that data collection requires precise and methodological arrangement in accordance with their common features so that the statistics can be reliable and comparable. The finance and insurance survey is subject to international standards in terms of collecting and classifying its data as it uses the following classification:

• National Classification of Economic Activities (ISIC 4):

It is a statistical classification that adopts the International Standard Industrial Classification of All Economic Activities (ISIC) which is the reference classification of all production activities. The purpose of using such classification in the finance and insurance survey is to specify the economic activity undertaken by the establishment.

6. Design of Survey Questionnaire:

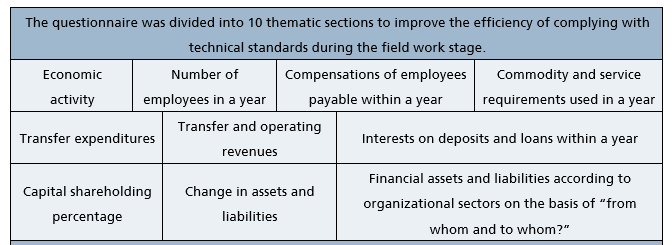

Field Data Collection Questionnaire:The survey questionnaire was drafted and designed by finance and investment statistics experts at GaStat. International recommendations, standards, and definitions were taken into consideration during the design of the questionnaire, which was presented to finance and insurance experts and specialists, as well as to relevant entities to obtain their insights and comments. Questions were redrafted based on a specific scientific approach aimed at unifying question formats used by researchers.

The complete questionnaire can be viewed and downloaded through GaStat’s official website:

After being approved, the survey questionnaire will be transformed into an electronic questionnaire that can be handled through the advanced data collection system using tablet devices. The system has the following features:

1. Reviewing the work zone of the field researcher (survey sample).

2. Reaching the sample (establishment) using the map on the tablet device.

3. Completing data of high quality using data check rules and navigation (to automatically detect input errors and illogical inputs while the completion of the data is underway).

4. Establishing communication between supervising entities by exchanging comments with field researchers.

7. Coverage:

7.1 Spatial Coverage:

The finance and insurance survey covers data related to finance and insurance activity in all 13 administrative regions of the Kingdom of Saudi Arabia, which are: (Riyadh, Makkah, Madinah, Qassim, Eastern Region, Asir, Tabuk, Hail, Northern Borders, Jazan, Najran, Al-Baha, and Al-Jouf). A scientifically selected sample is visited in each region representing the region’s establishments that practice financial and insurance activities.

7.2 Temporal Coverage:

It is carried out during the period set for visiting the targeted establishments of the survey sample and completing the survey questionnaire data. The survey data are usually associated with the year that precedes the period of conducting it.

8. Statistical Framework:

• The updated 2015 census of the 2010 Establishment Census was used as a list containing all population items.

• The lists, maps and analytical standards of the units were set to choose data providers (establishments).

• The required descriptive data were identified in order to create the statistical framework, create the test framework, verify them, and use them for the current survey round.

9. Sample design:

1. A perfect plan is designed and documented to choose the sample units from which data will be collected with providing guarantee for obtaining efficient and highly effective estimations. Therefore, the survey population was divided into non-overlapping parts characterized by the homogeneity of their units. Every part is considered a layer, and every layer is treated as an independent population where a random sample would be drawn separately from every layer. At the end, all drawn sampling units will be integrated to form an aggregate sample.

2. Choosing the sample units is done on the basis of the 2010 Establishment Census. In order to choose samples for surveys and statistical studies targeting establishments in general, the framework was divided into four categories on the basis of the establishment’s size as follows:

• Micro-establishments: It includes all establishments that have a workforce of 1-5.

• Small establishments: It includes all establishments that have a workforce of 6-49.

• Medium establishments: It includes all establishments that have a workforce of 50-249.

• Large establishments: It includes all establishments that have a workforce of more than 250.

3. The optimal sample unit selection methodology was prepared with the aim of providing high-quality outputs with minimum burden on data providers using methods of rotation and overlap control.

4. Required descriptive data are specified to apply the statistical framework and to allocate and choose the sample.

5. The sample is tested, assessed and verified, and its use in the current survey round is approved.

Third Stage: Organization:

It is the final preparation stage and precedes data collection. In this stage, the required workflow procedures are established for preparing the finance and insurance survey, starting with the collection stage and ending with the assessment stage and the organization and grouping of those procedures. The optimal sequence of those procedures is chosen to arrive at a methodology that achieves the goals of the statistical product. A review was made in this stage of the procedures that were taken upon the preparation of the previous version of the finance and insurance survey to develop the work procedures in the current version. Those procedures were also described and documented to facilitate any updates in future rounds. The statistical workflow procedures were tested and examined to ensure their compliance with the requirements of preparing the finance and insurance survey, approve the procedures of the statistical workflow, and develop a roadmap for implementation.

Testing the efficiency of input systems and the process of transmitting, synchronizing and reviewing data through either the tablet or office system of the finance and insurance survey are the main procedures in this stage.

Fourth Stage: Data Collection:

Finance and Insurance Survey Data Collection:

First: The survey sample was chosen through identifying 302 establishments as a selected sample that represents the survey population at the level of the Kingdom and is distributed among the thirteen administrative regions of the Kingdom of Saudi Arabia.

Second: The workers, who were nominated as field researchers and visited the establishments to collect data, were chosen on the basis of several practical and objective criteria related to the nature of work, such as:

• Educational level.

• Fieldwork experience.

• Personal attributes, such as: good conduct, evidence of senses and physical and psychological fitness.

• Candidate’s success in the training program of the finance and insurance survey.

• The candidate shall not be under the age of 20.

Third: All candidates (GaStat staff and collaborators from some government entities) were qualified and trained through special training programs as follows:

• A training program was held for expert staff members in GaStat’s headquarters for one week.

• Similar training programs were held for collaborating inspectors, observers, and researchers from all the regions of Saudi Arabia.

.

Fourth: The method of direct contact with the establishment was adopted in the process of completing the survey questionnaire and data collection. The field researchers visited the establishments located within the survey sample after arriving at it using the coordinates recorded on the tablets and the guiding maps and introducing themselves and showing official documents proving their statistical identity. They also clarified the aim of their visit, and presented an overview of the survey and its objectives. The electronic questionnaire was then completed orally through direct contact with the owner of the establishment or any official who is familiar with its affairs.

Fifth: All field researchers used tablet devices to collect the survey questionnaire data according to timeframes specified based on the number of establishments and their characteristics.

Sixth: Field researchers at all work locations in the Kingdom used the “synchronization” feature available on the tablet devices to download and transfer the completed data of the establishments directly to the database linked to them at GaStat’s headquarters where they are stored in a specific way to be reviewed and processed at a later stage.

Seventh: Electronic check rules were applied to guarantee the accuracy, consistency, and rationality of the data entered in the finance and insurance survey questionnaire. They are electronic rules that identify contradictions and they were designed by using a logical link between the answers of the questionnaire and its variables to help field researchers directly identify any errors upon completing the survey data with the official in charge of data provision. Those programmed rules don’t allow any mistakes to go through when an answer contradicts with another piece of information or another answer in the questionnaire.

Eighth: The collected data were verified through being reviewed by the field researcher, their inspector and the survey supervisor in the supervision area. All work areas were subjected to a monitoring and reviewing process from the Data Quality Room at GaStat’s headquarters. The room also controls and monitors the performance of all working groups in the field during the data collection process, starting from the first day and until the last.

Fifth Stage: Disaggregation:

The disaggregation of the raw data of the finance and insurance survey relied on the classification and coding inputs completed during the data collection process, whether they are classified based on the national classification of economic activities, or other classifications such as the distribution of data at the level of administrative regions.

Data related to the finance and insurance survey have been displayed in suitable tables to facilitate summarizing, understanding and drawing conclusions from them, as well as comparing them to other data, observing statistical significance as they relate to the study’s population, and viewing data without the need to go back the original questionnaires. These tables contain data such as: The names and addresses of establishments and the names of data providers in violation of the principle of statistical data confidentiality.

Data is processed at this stage through taking a number of steps, mainly:

First: Verifying Data Comprehensiveness and Coherence:

Data are reviewed and matched to ensure their accuracy and precision in a way that suits their nature with the aim of giving the presented statistics quality and accuracy. Data of the bulletin's current year are compared with the data of the previous year to ensure their integrity and consistency in preparation for processing data and extracting and reviewing results in the stages that follow the disaggregation stage.

Second: Data anonymization:

To ensure data confidentiality, GaStat removed identifiers from a set of input field survey data, such as hiding the name and address of the establishment owner and other identifiers to ensure the protection of people’s privacy.

Sixth Stage: Reviewing:

First: Verifying data outputs:

After reviewing and verifying the accumulated data of the finance and insurance survey, GaStat conducted at this stage processes of calculating and extracting results and uploaded and stored them on the database. The final reviewing processes were conducted by specialists in financial and investment statistics using modern technologies and software designed for the purposes of reviewing and checking.

Second: Handling of confidential data:

Pursuant to Royal Decree No.23 dated 07/12/1397, GaStat is committed to the absolute confidentiality of all completed data and not using them except for statistical purposes. Therefore, data are safely stored on GaStat’s servers.

Seventh Stage: Publication:

First: Preparing and setting results for publication:

In this stage, GaStat uploaded the data results from the finance and insurance survey database. The Authority then prepared publication tables and graphs for both data and indicators, and added descriptive and methodological information to them. These were prepared in both Arabic and English.

Second: Preparing media material and announcing the bulletin’s release date:

After GaStat announced the Bulletin’s release date on its official website at the beginning of the calendar year, the Authority prepares the required media materials to announce the Bulletin’s release on all media outlets, as well as its various social media platforms. The announcement will be made on the date set for publication. The bulletin will be published on the official website in various templates of open data in Excel format.

to guarantee its circulation and accessibility to all clients and parties interested in financial and insurance activities. The bulletin is included in the website’s statistics library.

Third: Communicating with clients and providing them with the bulletin:

GaStat pays great importance to communicating with clients who use its data. Therefore, GaStat contacts clients upon the release of the finance and insurance survey bulletin to provide them with it. GaStat also receives questions and enquiries from clients regarding the bulletin and its results through various communication channels. Clients can contact GaStat to request data. Questions and inquiries are received via:

- GaStat official website: www.stats.gov.sa

- GaStat email: info@stats.gov.sa

- Client Supportemail: cs@stats.gov.sa

- Visiting GaStat’s headquarters in Riyadh or one of its branches in the regions of the Kingdom.

- • Official Letters.

- By Statistical Phone: (920020081).

Fourth: Preserving the published content:

GaStat’s Documents and Archives Center stored and archived the data of this bulletin to refer to it at any time on request. GaStat took that step out of its awareness of the importance of electronically preserving those data to easily refer to them when needed.

Eighth Stage: Assessment:

After the bulletin is released and received by all GaStat’s clients, the clients are contacted again in this stage which allows for assessing the whole statistical process that was carried out, with the aim of constant improvement to obtain high-quality data. The improvements may include methodologies, processes, systems, statistical researchers’ skill and statistical frameworks. This stage is done in collaboration with data users and GaStat’s clients through a number of steps:

First: Collecting measurable assessment inputs:

Main comments and remarks are collected and documented from their sources at all stages, including those collected and documented during the collection stage, such as: comments and remarks presented by data collectors and their field supervisors, in addition to data collected and documented during the assessment stage such as the remarks deduced by specialists concerned with reviewing, checking and analyzing data collected from the field. Finally, comments and remarks presented by data users are collected and documented after publication, in addition to what is being monitored via media outlets or the clients’ remarks which GaStat receives through its main channels.

Second: Making the assessment:

Collected assessment inputs were analyzed, and the results of this analysis were compared with pre-anticipated results. Accordingly, potential improvements and solutions were identified and discussed with experts and concerned parties. In this stage, the performance of clients’ use of the results of the finance and insurance survey and their satisfaction with it is measured. Based on that, recommendations are developed to enhance the quality of the results of the next finance and insurance survey.

Ninth Stage: Management:

A comprehensive stage that spans over all the stages of producing the finance and insurance survey. This stage determines the general production plan, including the feasibility study, risk management, means of funding, disbursement mechanisms, as well as developing performance indicators, quality parameters, human resources map necessary for production, following up on the execution of tasks assigned to all departments in every stage, and making reports to ensure that the GaStat fulfills its commitments towards its clients.

Allah is the Arbiter of Success.

عنوان الملف:

Financial and Insurance Institutions Survey Form